The United Kingdom’s Joint Committee on Human Rights is evaluating its forced labour response, launching a new inquiry into the country’s current legal and voluntary frameworks. The UK Parliament’s committee announced the inquiry into forced labour in UK supply chains in January, noting that the country may have ‘fallen behind’ other countries in its response to the issue.

The inquiry will examine the effectiveness of the country’s current legal and voluntary frameworks in addressing forced labour, including the 2015 Modern Slavery Act, and whether changes are needed to improve the government’s response. This inquiry comes after recent media investigations have brought to light the alarming prevalence of forced labour within international supply chains. Reports have revealed that goods produced under forced labour conditions are making their way onto the UK market. Parliament notes a recent report exposing processed tomatoes sold as being produced in Italy were found to likely have been produced under forced labour conditions in China.

These investigations have raised significant concerns about the effectiveness of current measures to prevent such practices. Parliament’s inquiry will also explore how businesses can better manage the risk of forced labour in their supply chains and protect consumers.

EiQ data indicates ‘high risk’ for forced labour in the UK

Data from EiQ, LRQA’s supply chain intelligence software, reflects the concerns around the UK's forced labour risk. According to EiQ’s latest supply chain ESG risk ratings, derived from extensive onsite audit data, the UK shows a significant worsening score in its forced labour risk rating over the past year. Be it through increased audit volume or higher findings related to the issue, EiQ now ranks the UK among ‘high-risk’ countries for labour rights violations, worsening by a notable 58% margin in its Forced Labour Index since 2023. Findings related to the exploitation of foreign migrant workers and other labour violations attributed to the country’s high-risk indicator.

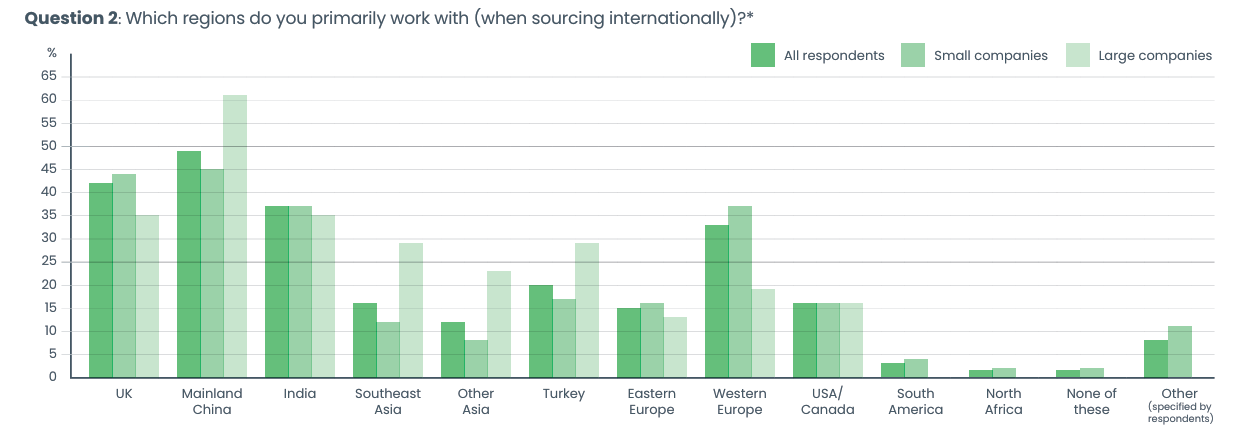

The 2025 State of Sourcing Report published by Source Fashion, which surveys large and small retailers in the UK found that while a large portion of UK retailers say they source domestically from the UK, a large portion (74% of those surveyed) source internationally, from countries such as China, India and Western Europe.

2025 State of Sourcing Report, State of Fashion

2025 State of Sourcing Report, State of Fashion

According to EiQ data, countries primarily used for sourcing, such as China and India, also exhibit high or extreme risk levels for forced labour violations, leaving businesses further vulnerable to connections to labour malpractices in their supply chains.

The need for enhanced supply chain risk management

What could be done to improve corporations’ ability to identify forced labour risks in supply chains, and select suppliers that meet government’s expectations? Where forced labour is a risk, what level of investigation/due diligence is it reasonable to expect from companies and public sector buyers before deciding whether to contract with suppliers? These questions outlined in the UK’s inquiry are exactly the questions we answer for EiQ clients every day.

Businesses must take proactive steps to enhance their supply chain risk management practices. This includes conducting thorough due diligence, harnessing transparent data, leveraging quality insights, implementing robust monitoring systems and fostering stronger supplier relationships. By doing so, companies can not only comply with existing legislation but also contribute to the broader goal of eradicating forced labour from supply chains. Amid disputes around deregulation and scaling back current laws in the United States and EU, the forced labour issue in the UK is prevalent, and the government’s inquiry underscores the need for businesses to enhance and develop their supply chain risk management strategies.

This inquiry is a call to action. Businesses need to move beyond mere compliance and embrace a proactive approach to identify and mitigate forced labour risks.

See how EiQ can help you to understand your supply chain’s ESG risk exposure